Companies have insight into the financial, legal, and regulatory risks involved in the M&A process — but what about cyber risk?

When cybersecurity due diligence has traditionally occurred, it tends to be a “check-the-box” discussion to ensure there aren’t any glaring red flags. That’s not enough - an inadequate cybersecurity review can introduce unwanted threats that aren’t detected until it’s too late or after a merger occurs, negatively impacting the deal’s value and completion.

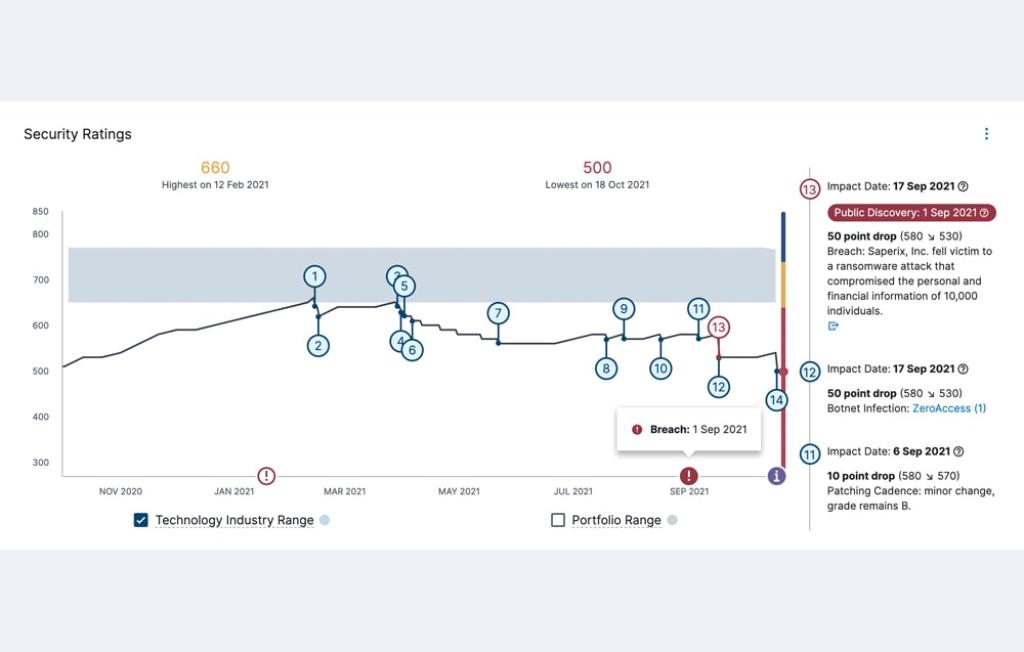

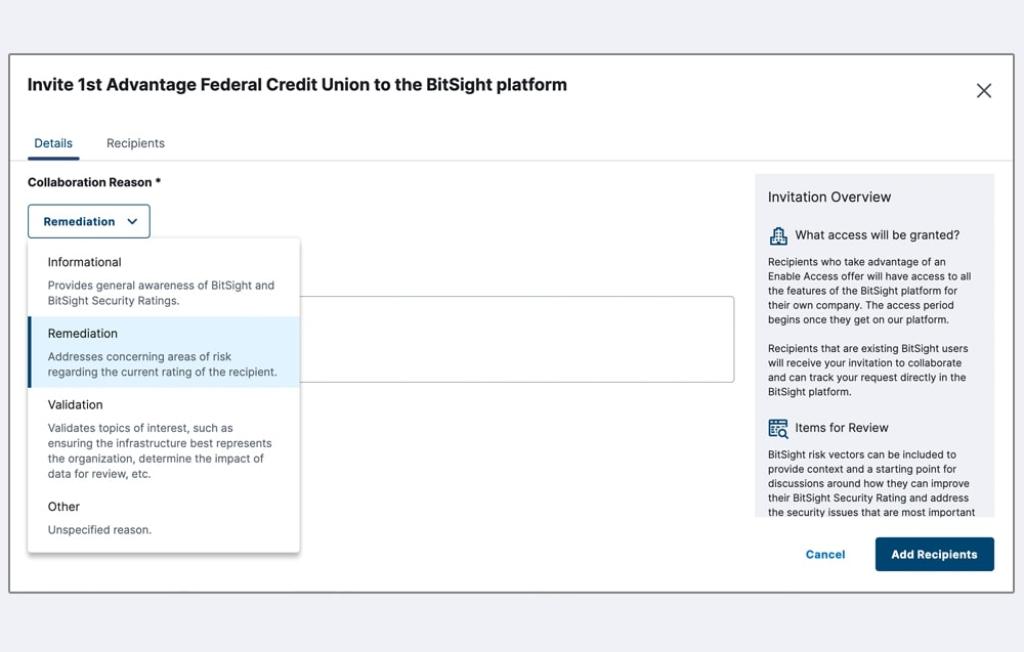

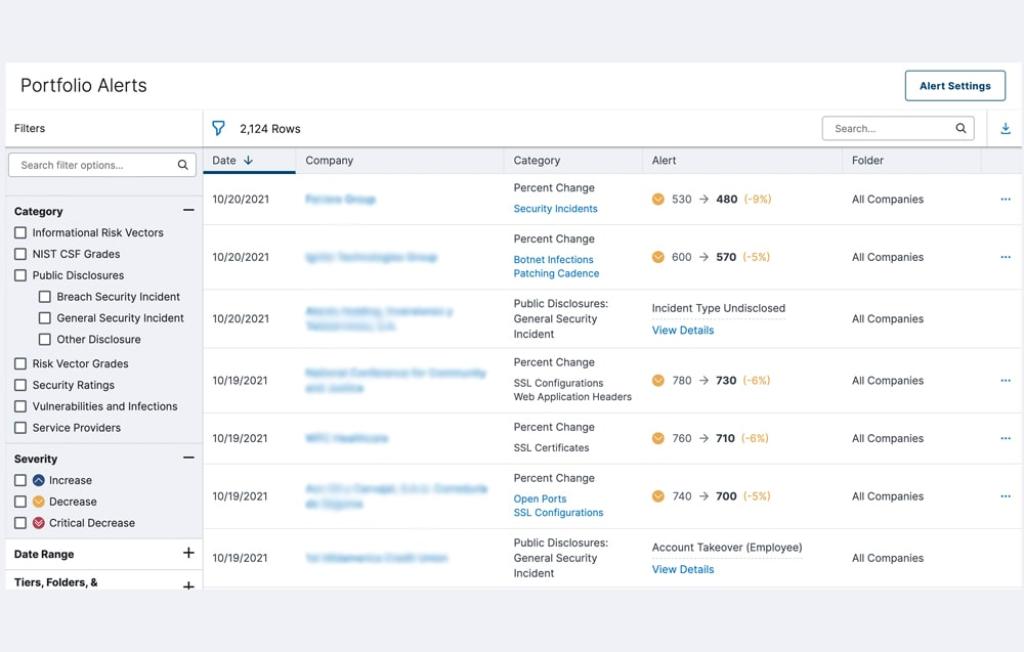

To proactively mitigate risk, companies need automated tools that continuously and objectively measure and monitor the security of potential acquisitions and current investments.