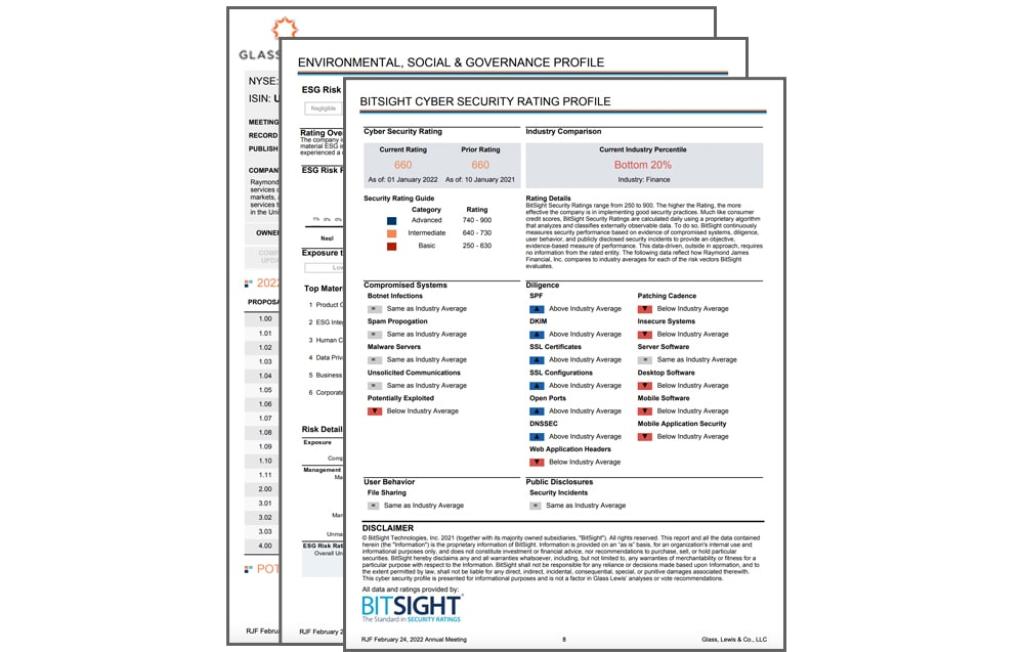

Bitsight is the leading provider of cyber governance data.

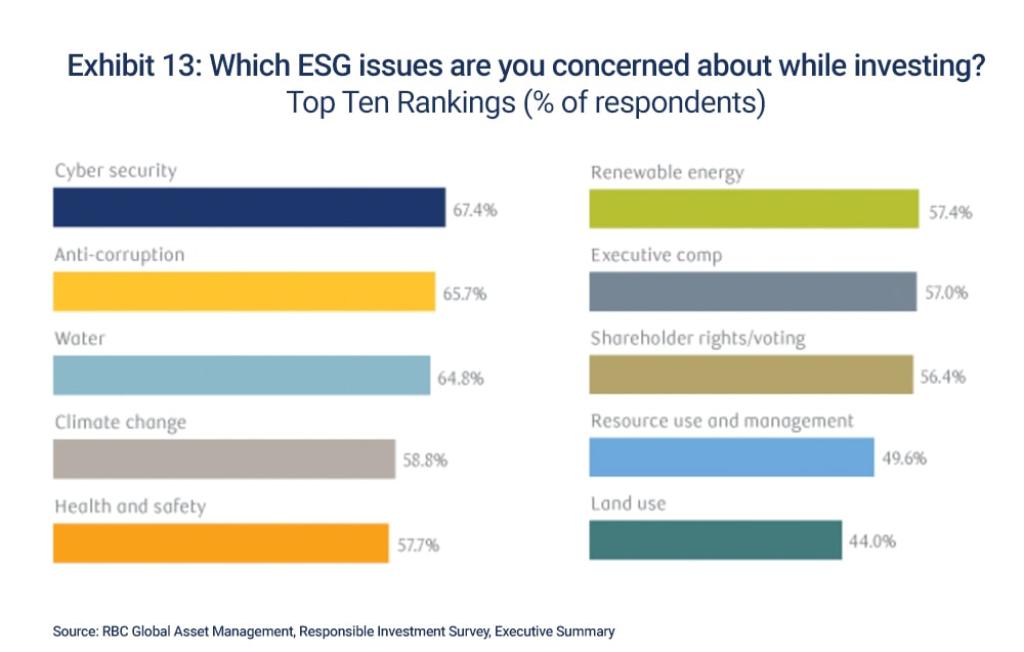

Cybersecurity is a critical risk that can materially impact a company’s bottom line. Unfortunately, investors are largely in the dark when it comes to understanding the cybersecurity of the companies in which they invest. Though widely recognized as a key component of governance, there is a lack of disclosure as it relates to cybersecurity investment, policy, and readiness from companies in general.

Updated daily, Bitsight Security Ratings are designed to continuously assess the likelihood of data breach and measure how effective an organization is at managing their cybersecurity environment, in an evidence-based, quantitative manner.