5 Credible Cybersecurity Threats To The Financial Services Sector

The financial services sector has traditionally been viewed as highly mature when it comes to cybersecurity initiatives. In fact, this Bitsight Insights report found that the financial sector had the highest Security Rating of all examined industries. But even though companies in the financial sector has been discussing the necessity of monitoring cybersecurity for quite some time, the threat landscape is constantly evolving—leading to a more complex cyber ecosystem every day. This makes it all the more critical to be proactive when it comes to cybersecurity issues.

The fact of the matter is, the data managed by financial service companies adds to the underlying threat landscape. The more sensitive data you hold as a company, the larger the target you become for cyber criminals. So it follows that financial service companies will always be a prime target.

You know the risk of a cyber incident when it comes to finances or operations. But what happens if your company’s reputation suffers?

The current cybersecurity situation is further exacerbated because of the threat of losing business in the event of a cyber attack. Customers trust you to protect their personal and financial information; a data breach threatens that trust, and may result in a loss of business. Consumers today are well-informed about cybersecurity threats and want to see that your organization prioritizes data protection.

If that alone isn’t enough reason to keep cybersecurity top of mind, business demands in the financial services sector are growing constantly—which means threats are growing constantly. With all of that in mind, we’ve outlined five credible cybersecurity threats to the financial services sector.

5 Credible Cybersecurity Threats To The Financial Services Sector

1. Third-Party Cybersecurity Risk

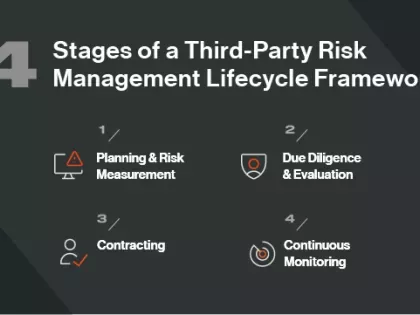

The threat of third-party cybersecurity—and the question of how to scale your cybersecurity program to more closely monitor your vendors’ security postures—looms large in the financial services sector. Does your organization have the ability to continuously monitor each vendor you work with? Do you have a system for collaborating with vendors (and collaborating internally) on cybersecurity measures and determining what can be done to protect your data? It’s necessary to be able to rapidly identify and remediate issues if need be, so having a continuous monitoring tool will give you peace of mind.

2. Fourth-Party Cybersecurity Risk

In 2015, the New York State Department of Financial Services conducted a survey that revealed a large percentage of organizations in the financial sector weren’t adequately monitoring their fourth parties. Fourth-party cybersecurity—monitoring the security of your vendors’ third parties—is a credible threat to nearly every organization.

Let’s say one of your fourth parties is affected by a ransomware attack that takes them offline for a long period of time. Do you know how that outage would affect your vendors in addition to your organization’s critical information, or that of your customers? Part of the trouble with this threat is that many organizations aren’t aware of their fourth parties. If you find yourself in this camp, you’ll want to take a few steps:

- First, begin a discussion with your third-party vendors to find out whether the critical data you share with them is being passed along through any service providers with poor security practices.

- Second, thoroughly assess the security and cyber risk of all your fourth parties using an unbiased, data-driven tool like Bitsight.

- Finally, dig into any regulatory guidelines to be sure you’re doing your part in keeping your data safe.

3. Widespread Business Operation Risk

For financial service organizations that operate at an international level—or simply operate across a widespread geographic area—the threat of cybersecurity issues increases. Large financial companies around the world have to consider additional cybersecurity risks across their hubs of business. If this describes your organization, consider the following questions to help address your vast security landscape:

- Does your security risk change per region? If so, how?

- How are you able to ensure our network is protected across different regions of the world?

- If the business expands, do you have enough information to understand how your cyber risk will change?

- What regions do your vendors operate in? What regions do their vendors operate in?

4. Distributed Denial-Of-Service (DDOS) Attacks

In the 2017 Verizon Data Breach Industry Report (DBIR), DDOS attacks are highlighted as an emerging risk for organizations. Take the 2016 Dyn breach, for example. The relatively small DNS service provider was hit with a DDOS attack, causing massive outages across companies like Amazon and Paypal during the attack. Popular security blog Krebs on Security was also hit with a major DDoS attack—which Brian Krebs followed up on with an interesting series of articles identifying the people who attacked him and speculating on the reasons they brought his website down.

Well-known and widely discussed DDOS attacks like these have helped to highlight this threat—and serve as a wake-up call to the financial services industry to do everything possible to monitor exposure to them.

5. Open Ports

Open ports aren’t dangerous by nature, but when sensitive information exists, is managed, or is transferred through those ports, the potential for a breach increases. One of the foundations of the WannaCry ransomware attack was the open port 445.

While simply having good network hygiene is important, it’s critical to have a solid plan in place for port management. Financial service industries in particular have a lot to lose if they are not careful with open ports on their network or the network of their trusted third parties.

In Summary

Because cybersecurity risks like these have the potential to impact the health of your organization, your strategies for managing them need to be considered on a regular basis. To avoid the five credible cybersecurity threats listed above, you must understand and take into account the cybersecurity implications of the vendors you do business with (and the vendors they do business with), the places you do business in, and how well your network security is configured.