Analyzing Cybersecurity & Reputational Risk Management In Financial Institutions

Tags:

Reputational risk is the potential for damage to an organization’s character or good name. If a bank or financial institution is hit with an incident that puts a mark on its reputation, the event could compromise the company’s perceived legitimacy, thus affecting the number of current customers, prospective customers, shareholders, and the stock price. And because information is disseminated online and through social media so rapidly, this type of event could cause reputational harm almost immediately.

That’s why reputational risk management (RRM) in financial institutions is so critical today. RRM is the process of avoiding or mitigating the potential loss of an organization’s character, and it is something more and more senior executives—from board members and the executive management team down to the CIO and CISO—are increasingly concerned about. And rightfully so! All of these individuals want to know the company is doing everything to avoid an incident that could cause long-term reputational damage to their company.

The Center for Financial Professionals conducted an interview with Maria Leistner, Credit Suisse's managing director and chair of the Reputational Risk Committee, on why reputational risk management in financial institutions is critical today:

“Reputational Risk has always been of significant importance for financial institutions, but its focus has changed over time. Post financial crisis, it needs to address views and potential concerns of an increased number of stakeholders. We now operate in an environment where “should we do it” has to be the prism through which we need to consider any dealings with counterparties and transactions. The reputational risk has also now become more than ever a responsibility of everyone else working for a financial institution. Many financial institutions are working on embedding the reputational risk awareness as part of changing their culture.”

Cybersecurity & Reputational Risk Management

Monitoring your IT and cybersecurity environment is absolutely critical in order to quickly identify and remediate security incidents when they occur. Furthermore, companies want their cybersecurity as tight as possible in an effort to prevent data incidents from becoming material, reputation-ruining events.

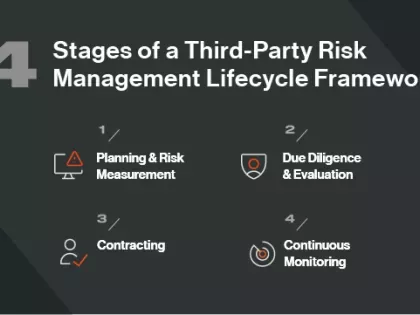

Continuous security monitoring programs are powerful tools for companies who want to measure their cybersecurity performance—and the cybersecurity of their third parties—to reduce potential risk. And in organizations with extensive oversight from regulatory bodies, clients, or customers—like those in the financial or healthcare industries—sophisticated cybersecurity practices like continuous monitoring help maintain legal, regulatory, and fiduciary responsibilities.

Proper cybersecurity monitoring tools can have a positive impact on your organization’s reputation. These tools can protect your shareholders and your company value, act as a competitive differentiator in the marketplace, and aid in third-party risk management.

Download Now: Why Reputational Risk Management Is So Critical For Your Organization

While it is tempting to rely solely on a PR strategy to take care of any reputational risk in banks and financial institutions, PR is reactionary—not preventative. And in today’s risk environment, putting a strong RRM strategy with continuous security monitoring in place is the best way to avoid reputational harm.

You know that guarding your reputation is critical—but do you know how to do so? This free ebook gives you four critical insights on why cybersecurity monitoring should be an integral part of your reputational risk management strategy. Download it today!